Top 5 airport trends in aeronautical charging to grow income and address the capacity crisis

With the Airport Council International (ACI) forecasting a 30% global rise in air travelers from 2017 to 2021, the threat of demand outstripping available airport infrastructure is becoming ever more an issue.

Facing increasing capacity constraints, airport operators are turning to their commercial and finance teams to help reduce revenue leakage and fund future infrastructure development and service improvements.

Revenue management is now no longer the end of the chain – it’s a strategic component of an airport’s growth and efficiency. From structured landing charges to tiered aircraft parking pricing, itemised infrastructure fees and incentivised passenger charges, new trends in aero billing are helping airports improve cash flow visibility and reduce the cost and time to invoice.

Industry revenue snapshot

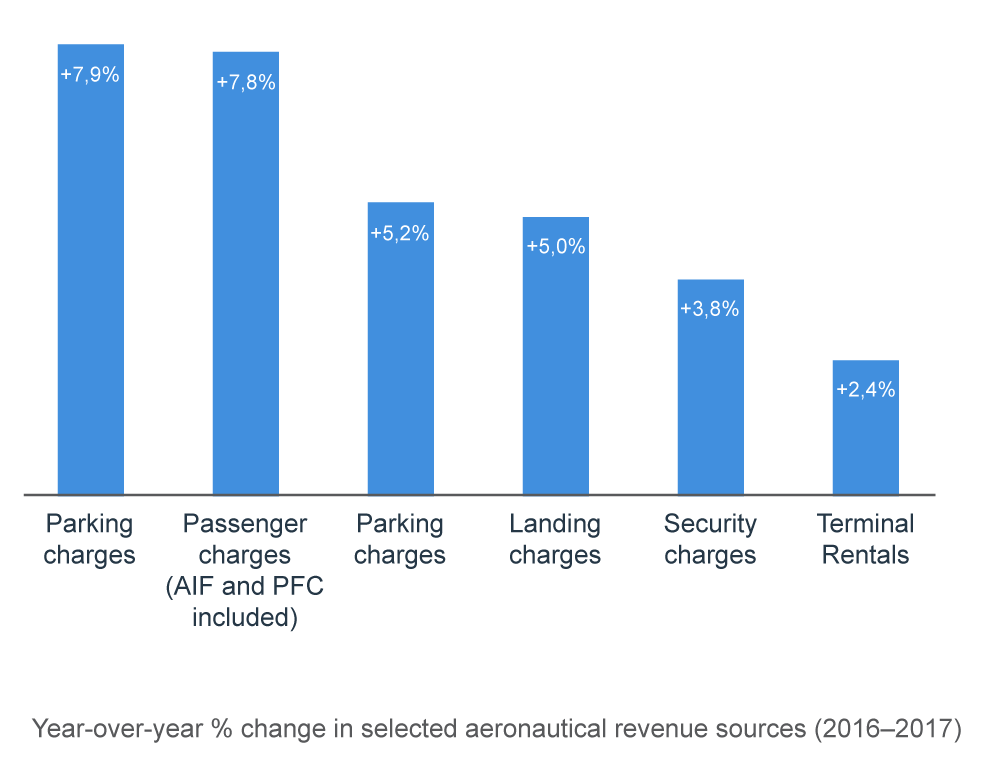

In 2017, total annual airport revenue grew by 6.2% globally to US$172.2 billion, with aeronautical revenue representing the most substantial part of the industry’s total income at 55.8%.

While this growth is linked with the increase in passenger numbers passing through airport gates, total revenue per passenger has remained relatively flat – dropping by around 0.5% annually for the past three years. Aeronautical income, at $10 a passenger, is also stable, with regulation and competition between airports for both airlines and passengers, keeping a lid on any price hikes.

Types of airport fees

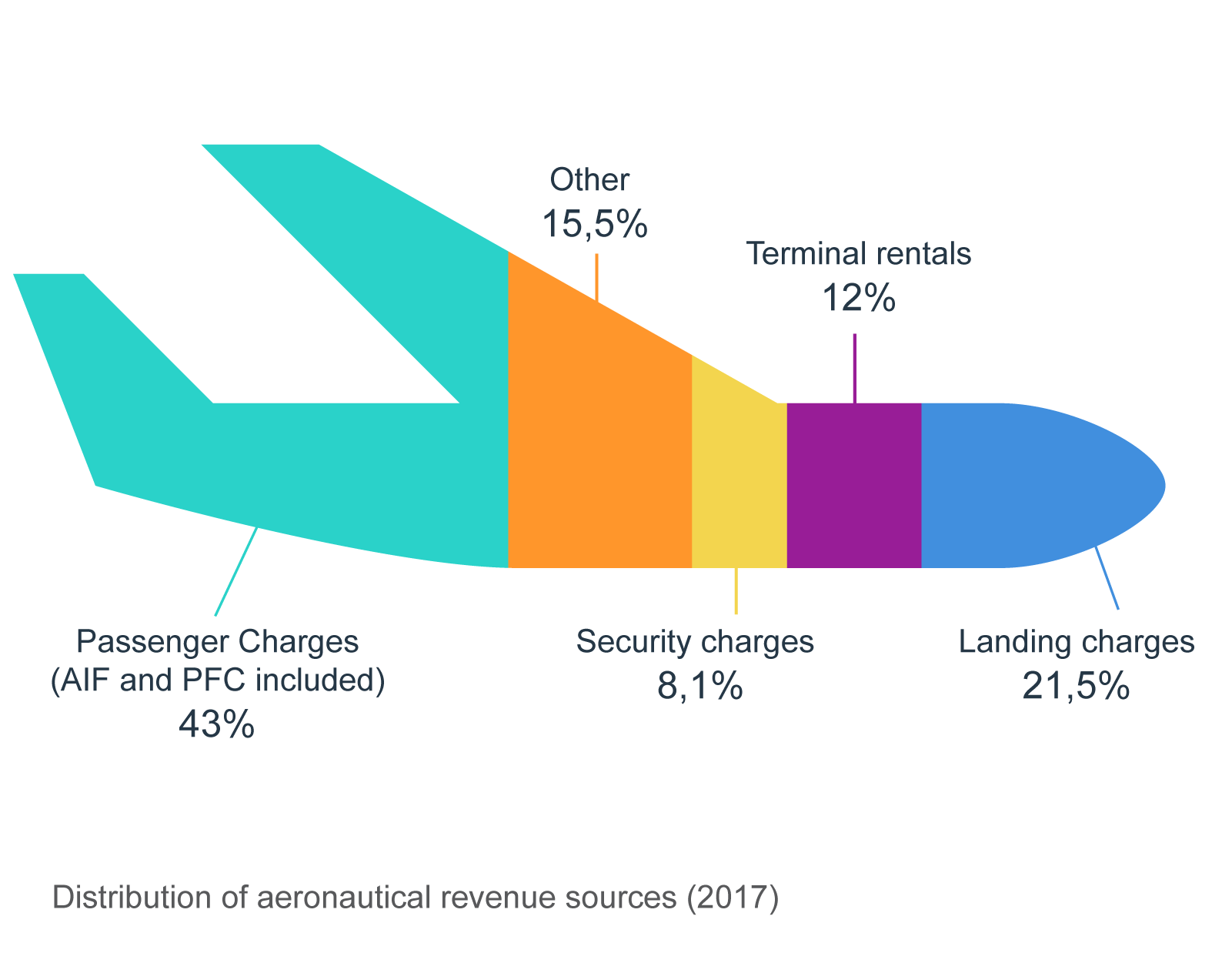

Aeronautical revenues are generated from an array of charges and fees that are levied on aircraft operators and passengers for airport facilities and services.

For aircraft operators – These charges are usually based on an aircraft weight formula and include runways, taxiways, aprons, parking stands and boarding bridges.

For passengers – Collected by carriers for the airport, these include passenger service or terminal charges and security charges and are accrued on a per-passenger basis.

Source: ACI Airport Economics Report 2019

Top 5 trends in optimising aeronautical revenue*

1. Airport landing fees – tiered by aircraft weight or passenger volume

While some airports have shifted towards tiered pricing to reflect the cost of servicing large aircraft, others are building passenger charges into landing fees.

Gatwick Airport has differentiated rates for summer peak, summer base, summer off-peak and winter

Sydney Airport uses a single charge levied on a per passenger basis, which includes an element for the landing, security and terminal use charge

Frankfurt Airport now has a two-tier structure to its landing charge, with part of the charge being raised on a per passenger basis.

2. Aircraft parking fees – differentiated pricing for stands

Many airports are reviewing how they handle aircraft parking. Several now offer differentiated pricing for contact and remote stands, widebody and narrow body aircraft, or to encourage usage of less congested stands.

Dublin Airport, the fastest growing airport in Europe for the last eight years, has removed all free parking of aircraft with a dynamic tiered pricing charge structure in 15 min blocks.

3. Infrastructure and services – itemised charging and incentives

Increasingly infrastructure charges are being separated from terminal charges. This allows airports to offer a portfolio of services to attract both full service and low-cost airlines, such as buses, airbridges, electricity or preconditioned air.

Hong Kong Airport has consolidated multiple billing systems onto one platform, delivering granular charging such as hand baggage limitations, parking utilities, and overnight charging discounts.

4. Environment – noise and emission charges

Many airports are now encouraging airline customers to invest in new quieter and more environmentally friendly flights by the introduction of aircraft noise and emissions-related charges.

Helsinki Airport, carbon neutral since 2017, has evolved noise charges with a sliding scale of aeronautical charges according to factors such as aircraft weight, engine rating and time of day.

5. Passengers – discounts for airline efficiency

Many of the world’s major airport hubs generate the majority of their revenue from passengers. In the US, where passenger fees are capped at $4.50, several airports are adopting creative ways to better capture the costs associated with handling passengers. Internationally, many airports offer discounts and incentives on passenger fees to encourage more efficient operations.

Budapest Airport offers discounts of either 10% or 20% of the passenger charge for airlines achieving load factors of 90% or over.

The bottom line

As passenger numbers continue to surge, airports must find ways to grow revenue to fund airport expansion to cope with demand.

The primary way to do this is via aeronautical charges. However, aeronautical pricing structures are already less than straightforward. Airports must account for service level agreements, operating costs, passenger forecasts, current and future capital servicing cost requirements and local regulatory requirements.

Fortunately, airports are finding a way. By automatically linking capacity, resource and revenue data across the ecosystem, airports can quickly innovate with new incentive schemes and differentiated tariff structures. Ultimately, this charge flexibility eases throughput constraints while helping airports squeeze the most out of every dollar.